2020. 1. 23. 16:17ㆍ카테고리 없음

Contact-type smart cards may have many different layouts, such as these A smart card, chip card, or integrated circuit card ( ICC), is a physical electronic authorization device, used to control access to a resource. It is typically a plastic sized card with an embedded. Many smart cards include a pattern of metal contacts to electrically connect to the internal chip. Others are, and some are both. Smart cards can provide, data storage, and application processing.

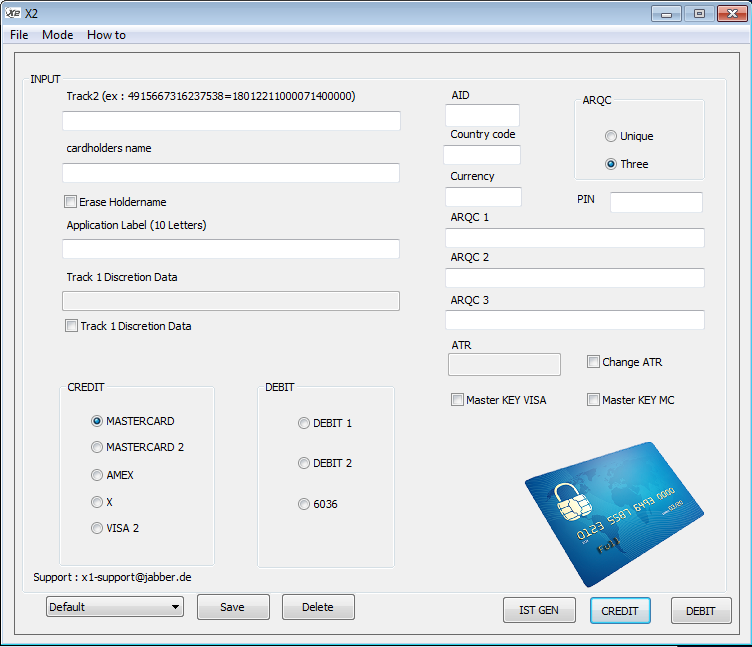

- X1 Emv Chipwriter Download For Windows 10

- X1 Emv Chipwriter Download For Windows 7

- X1 Emv Chipwriter Download For Windows 7

Applications include identification, financial, mobile phones (SIM), public transit, computer security, schools, and healthcare. Smart cards may provide strong security authentication for (SSO) within organizations. Several nations have deployed smart cards throughout their populations. Further information: Europay MasterCard Visa (EMV)-compliant cards and equipment are widespread with the deployment led by European countries.

The United States started later deploying the EMV technology in 2014, with the deployment still in progress in 2018. Typically, a country's national payment association, in coordination with International, International, and (JCB), jointly plan and implement EMV systems. Historically, in 1993 several international payment companies agreed to develop smart-card specifications for. The original brands were MasterCard, Visa,. The first version of the EMV system was released in 1994. In 1998 the specifications became stable. EMVCo maintains these specifications.

EMVco's purpose is to assure the various financial institutions and retailers that the specifications retain backward compatibility with the 1998 version. EMVco upgraded the specifications in 2000 and 2004.

EMV compliant cards were first accepted into Malaysia in 2005 and later into United States in 2014. MasterCard was the first company that was allowed to use the technology in the United States. The United States has felt pushed to use the technology because of the increase in. The credit card information stolen from Target in late 2013 was one of the largest indicators that American credit card information is not safe. Target made the decision on April 30, 2014 that it would try to implement the smart chip technology in order to protect itself from future credit card identity theft. Before 2014, the consensus in America was that there were enough security measures to avoid credit card theft and that the smart chip was not necessary.

USB Iso 7816 Mobile Ic Emv Chip Smart Card Reader Writer ACR38T Feature •Supports SIM-sized cards •Supports ISO-7816. •Credit card EMV chip reader supports Android iOS and Windows system •iPOS series products are developed to provide m. Download Electronics e-Magazine.

The cost of the smart chip technology was significant, which was why most of the corporations did not want to pay for it in the United States. The debate came when online credit theft was insecure enough for the United States to invest in the technology.

The adaptation of EMV's increased significantly in 2015 when the liability shifts occurred in October by the credit card companies. Development of contactless systems. See also: Contactless smart cards do not require physical contact between a card and reader. They are becoming more popular for payment and ticketing. Typical uses include mass transit and motorway tolls. Visa and MasterCard implemented a version deployed in 2004–2006 in the U.S., with Visa's current offering called. Most contactless fare collection systems are incompatible, though the Standard card from has a considerable market share in the US and Europe.

Use of 'Contactless' smart cards in transport has also grown through the use of low cost chips and paper/card/PET rather than PVC. This has reduced media cost so it can be used for low cost tickets and short term transport passes (up to 1 year typically).

The cost is typically 10% that of a PVC smartcard with larger memory. They are distributed through vending machines, ticket offices and agents. Use of paper/PET is less harmful to the environment than traditional PVC cards Greenpeace. Confidex. See also transport/transit/ID applications. Smart cards are also being introduced for identification and entitlement by regional, national, and international organizations.

These uses include citizen cards, drivers’ licenses, and patient cards. In, the compulsory national ID enables eight applications and has 18 million users. Contactless smart cards are part of to enhance security for international travel. Design A smart card may have the following generic characteristics:. Dimensions similar to those of a.

ID-1 of the standard defines cards as nominally 85.60 by 53.98 millimetres (3.37 in × 2.13 in). Another popular size is ID-000, which is nominally 25 by 15 millimetres (0.98 in × 0.59 in) (commonly used in SIM cards). Both are 0.76 millimetres (0.030 in) thick. Contains a security system (for example a and a secure ) and provides security services (e.g., protects in-memory information).

Managed by an administration system, which securely interchanges information and configuration settings with the card, controlling card and application-data updates. Communicates with external services through card-reading devices, such as ticket readers, etc. Smart cards are typically made of plastic, generally, but sometimes -based,. Since April 2009, a Japanese company has manufactured reusable financial smart cards made from paper. Contact smart cards. A smart-card.

RST: Reset signal, used to reset the card's communications. CLK: Provides the card with a, from which data communications timing is derived. GND: (reference voltage).

VPP: ISO/IEC 7816-3:1997 designated this as a programming voltage: an input for a higher voltage to program persistent memory (e.g., ). ISO/IEC 7816-3:2006 designates it SPU, for either standard or proprietary use, as input and/or output.

I/O: Serial input and output. C4, C8: The two remaining contacts are AUX1 and AUX2 respectively and are used for interfaces and other uses. However, the usage defined in ISO/IEC 7816-2:1999/Amd 1:2004 may have been superseded by ISO/IEC 7816-2:2007.

Contact smart cards have a contact area of approximately 1 square centimetre (0.16 sq in), comprising several gold-plated. These pads provide electrical connectivity when inserted into a, which is used as a communications medium between the smart card and a host (e.g., a computer, a point of sale terminal) or a mobile telephone. Cards do not contain; power is supplied by the card reader.

The and series of standards define:. physical shape and characteristics,. electrical connector positions and shapes,. electrical characteristics,., including commands sent to and responses from the card,.

basic functionality. Because the chips in financial cards are the same as those used in (SIMs) in mobile phones, programmed differently and embedded in a different piece of, chip manufacturers are building to the more demanding GSM/3G standards. So, for example, although the EMV standard allows a chip card to draw 50 mA from its terminal, cards are normally well below the telephone industry's 6 mA limit. This allows smaller and cheaper financial card terminals. Communication protocols for contact smart cards include T=0 (character-level transmission protocol, defined in ISO/IEC 7816-3) and T=1 (block-level transmission protocol, defined in ISO/IEC 7816-3).

Contactless smart cards. Main article: Contactless smart cards communicate with and are powered by the reader through technology (at data rates of 106–848 kbit/s). These cards require only proximity to an antenna to communicate. Like smart cards with contacts, contactless cards do not have an internal power source. Instead, they use an to capture some of the incident radio-frequency interrogation signal, it, and use it to power the card's electronics. Contactless smart media can be made with PVC, paper/card and PET finish to meet different performance, cost and durability requirements.

APDU transmission by a contactless interface is defined in -4. A hybrid smart card, which clearly shows the antenna connected to the main chip Hybrid cards implement contactless and contact interfaces on a single card with dedicated modules/storage and processing. Dual-interface Dual-interface cards implement contactless and contact interfaces on a single card with some shared storage and processing. An example is 's multi-application transport card, called, which uses a chip with both contact and (ISO/IEC 14443 Type B) interfaces.

USB The (Chip Card Interface Device) is a USB protocol that allows a smartcard to be connected to a computer, using a standard USB interface. This allows the smartcard to be used as a security token for authentication and data encryption such as. CCID devices typically look like a standard USB dongle and may contain a SIM card inside the USB dongle. Applications Financial Smart cards serve as credit or, mobile phone, authorization cards for pay television, household utility pre-payment cards, high-security identification and, and and public phone payment cards.

Smart cards may also be used as. The smart card chip can be 'loaded' with funds to pay parking meters, vending machines or merchants. Protect the exchange of money between the smart card and the machine.

No connection to a bank is needed. The holder of the card may use it even if not the owner. Examples are,. The German Geldkarte is also used to validate customer age at for cigarettes. Main articles: and These are the best known payment cards (classic plastic card):.

Visa: Visa Contactless, Quick VSDC, 'qVSDC', Visa Wave, MSD, payWave. MasterCard: PayPass Magstripe, PayPass MChip. American Express: ExpressPay. Discover: Zip. Unionpay: QuickPass Roll-outs started in 2005 in the U.S. Asia and Europe followed in 2006.

X1 Emv Chipwriter Download For Windows 10

Contactless (non-PIN) transactions cover a payment range of $5–50. There is an PayPass implementation. Some, but not all PayPass implementations conform to EMV. Non-EMV cards work like. This is common in the U.S. (PayPass Magstripe and Visa MSD).

The cards do not hold or maintain the account balance. All payment passes without a PIN, usually in off-line mode. The security of such a transaction is no greater than with a magnetic stripe card transaction. EMV cards can have either contact or contactless interfaces. They work as if they were a normal EMV card with a contact interface.

Via the contactless interface they work somewhat differently, in that the card commands enabled improved features such as lower power and shorter transaction times. SIM The used in mobile-phone systems are reduced-size smart cards, using otherwise identical technologies. Identification Smart-cards can identity. Sometimes they employ a (PKI). The card stores an encrypted digital certificate issued from the PKI provider along with other relevant information.

Examples include the (DoD) (CAC), and other cards used by other governments for their citizens. If they include biometric identification data, cards can provide superior two- or three-factor authentication. Smart cards are not always privacy-enhancing, because the subject may carry incriminating information on the card. Contactless smart cards that can be read from within a wallet or even a garment simplify authentication; however, criminals may access data from these cards. Cryptographic smart cards are often used for. Most advanced smart cards include specialized cryptographic hardware that uses algorithms such as and (DSA).

X1 Emv Chipwriter Download For Windows 7

Today's cryptographic smart cards generate key pairs on board, to avoid the risk from having more than one copy of the key (since by design there usually isn't a way to extract private keys from a smart card). Such smart cards are mainly used for and secure identification. The most common way to access cryptographic smart card functions on a computer is to use a vendor-provided library. On the (CSP) API is also supported. The most widely used cryptographic algorithms in smart cards (excluding the GSM so-called 'crypto algorithm') are.

The key set is usually loaded (DES) or generated (RSA) on the card at the personalization stage. Some of these smart cards are also made to support the (NIST) standard for, FIPS 201. Turkey implemented the first smart card driver's license system in 1987. Turkey had a high level of road accidents and decided to develop and use digital tachograph devices on heavy vehicles, instead of the existing mechanical ones, to reduce speed violations. Since 1987, the professional driver's licenses in Turkey have been issued as smart cards. A professional driver is required to insert his driver's license into a digital tachograph before starting to drive.

The tachograph unit records speed violations for each driver and gives a printed report. The driving hours for each driver are also being monitored and reported. In 1990 the European Union conducted a feasibility study through BEVAC Consulting Engineers, titled 'Feasibility study with respect to a European electronic drivers license (based on a smart-card) on behalf of Directorate General VII'. In this study, chapter seven describes Turkey's experience. Argentina's Mendoza province began using smart card driver's licenses in 1995.

Mendoza also had a high level of road accidents, driving offenses, and a poor record of recovering fines. Smart licenses hold up-to-date records of driving offenses and unpaid fines. They also store personal information, license type and number, and a photograph. Emergency medical information such as blood type, allergies, and biometrics (fingerprints) can be stored on the chip if the card holder wishes. The Argentina government anticipates that this system will help to collect more than $10 million per year in fines.

In 1999 was the first Indian state to introduce a smart card license system. As of 2005, it has issued 5 million smart card driving licenses to its people. In 2002, the Estonian government started to issue smart cards named as primary identification for citizens to replace the usual passport in domestic and EU use. As of 2010 about 1 million smart cards have been issued (total population is about 1.3 million) and they are widely used in internet banking, buying public transport tickets, authorization on various websites etc.

By the start of 2009, the entire population of was issued eID cards that are used for identification. These cards contain two certificates: one for authentication and one for signature.

This signature is legally enforceable. More and more services in Belgium use eID for. Started issuing national ID cards (DNI) in the form of Smartcards in 2006 and gradually replaced all the older ones with Smartcards. The idea was that many or most bureaucratic acts could be done online but it was a failure because the Administration did not adapt and still mostly requires paper documents and personal presence. On August 14, 2012, the ID cards in were replaced.

The Smart Card is a third generation chip-based that is produced according to international standards and requirements. The card has over 36 physical security features and has the latest encryption codes. This smart card replaced the NICOP (the ID card for ). Smart cards may identify emergency responders and their skills. Cards like these allow first responders to bypass organizational paperwork and focus more time on the emergency resolution.

In 2004, The expressed the needs: 'to enhance security, increase government efficiency, reduce identity fraud, and protect personal privacy by establishing a mandatory, Government-wide standard for secure and reliable forms of identification'. Personnel can carry these cards to be positively identified in emergency situations., a smart card provider to, produces cards that contain additional personal information, such as medical records and skill sets. In 2007, the (OMA) proposed a new standard defining V1.0 of the Smart Card Web Server (SCWS), an embedded in a SIM card intended for a user.

The non-profit trade association has been promoting the development and adoption of SCWS. SIMalliance states that SCWS offers end-users a familiar, -independent, browser-based interface to secure, personal SIM data. As of mid-2010, SIMalliance had not reported widespread industry acceptance of SCWS. The OMA has been maintaining the standard, approving V1.1 of the standard in May 2009, and V1.2 is expected was approved in October 2012. Smart cards are also used to identify user accounts on arcade machines. Public transit.

Further information:, and Smart health cards can improve the and of patient information, provide a secure carrier for portable, reduce, support new processes for portable medical records, provide secure access to emergency medical information, enable compliance with government initiatives (e.g., ) and mandates, and provide the platform to implement other applications as needed by the. Other uses Smart cards are widely used to digital television streams.

Is a specific example of how smart card security worked. Multiple-use systems The government promotes as a single system for all smart-card applications. MyKad started as identity cards carried by all citizens and resident non-citizens. Available applications now include identity, travel documents, drivers license, health information, an electronic wallet, ATM bank-card, public toll-road and transit payments, and public key encryption infrastructure. The personal information inside the MYKAD card can be read using special APDU commands.

X1 Emv Chipwriter Download For Windows 7

Security. This section needs additional citations for. Unsourced material may be challenged and removed. ( February 2016) Smart cards have been advertised as suitable for personal identification tasks, because they are to be. The chip usually implements some algorithm. There are, however, several methods for recovering some of the algorithm's internal state. Involves measuring the precise time and required for certain encryption or decryption operations.

This can deduce the on-chip private key used by public key algorithms such as. Some implementations of can be vulnerable to timing or as well. Smart cards can be physically disassembled by using acid, abrasives, solvents, or some other technique to obtain unrestricted access to the on-board microprocessor. Although such techniques may involve a risk of permanent damage to the chip, they permit much more detailed information (e.g., of encryption hardware) to be extracted.

Benefits The benefits of smart cards are directly related to the volume of information and applications that are programmed for use on a card. A single contact/contactless smart card can be programmed with multiple banking credentials, medical entitlement, driver's license/public transport entitlement, loyalty programs and club memberships to name just a few. Multi-factor and proximity authentication can and has been embedded into smart cards to increase the security of all services on the card. For example, a smart card can be programmed to only allow a contactless transaction if it is also within range of another device like a uniquely paired mobile phone. This can significantly increase the security of the smart card. Governments and regional authorities save money because of improved security, better data and reduced processing costs.

These savings help reduce public budgets or enhance public services. There are many examples in the UK, many using a common open specification. Individuals have better security and more convenience with using smart cards that perform multiple services. For example, they only need to replace one card if their wallet is lost or stolen. The data storage on a card can reduce duplication, and even provide emergency medical information. Advantages The first main advantage of smart cards is their flexibility. Smart cards have multiple functions which simultaneously can be an ID, a credit card, a stored-value cash card, and a repository of personal information such as telephone numbers or medical history.

The card can be easily replaced if lost, and, the requirement for a (or other form of security) provides additional security from unauthorised access to information by others. At the first attempt to use it illegally, the card would be deactivated by the card reader itself. The second main advantage is security.

Smart cards can be electronic key rings, giving the bearer ability to access information and physical places without need for online connections. They are encryption devices, so that the user can encrypt and decrypt information without relying on unknown, and therefore potentially untrustworthy, appliances such as ATMs. Smart cards are very flexible in providing authentication at different level of the bearer and the counterpart.

Finally, with the information about the user that smart cards can provide to the other parties, they are useful devices for customizing products and services. Other general benefits of smart cards are:. Portability. Increasing data storage capacity.

Reliability that is virtually unaffected by electrical and magnetic fields. Smart cards and electronic commerce Smart cards can be used in, over the Internet, though the business model used in current electronic commerce applications still cannot use the full potential of the electronic medium. An advantage of smart cards for electronic commerce is their use customize services. For example, in order for the service supplier to deliver the customized service, the user may need to provide each supplier with their profile, a boring and time-consuming activity. A smart card can contain a non-encrypted profile of the bearer, so that the user can get customized services even without previous contacts with the supplier. Disadvantages.

A false smart-card, with two 8-bit CMOS, used in the nineties to decode the signals of Sky Television. The plastic or paper card in which the chip is embedded is fairly flexible. The larger the chip, the higher the probability that normal use could damage it.

Cards are often carried in wallets or pockets, a harsh environment for a chip and antenna in contactless cards. PVC cards can crack or break if bent/flexed excessively. However, for large banking systems, failure-management costs can be more than offset by fraud reduction. The production, use and disposal of PVC plastic is known to be more harmful to the environment than other plastics. Alternative materials including chlorine free plastics and paper are available for some smart applications.

If the account holder's computer hosts, the smart card security model may be broken. Malware can override the communication (both input via keyboard and output via application screen) between the user and the application. Malware (e.g., the Trojan ) could modify a transaction, unnoticed by the user. Banks like and in Belgium and (') in the Netherlands combine a smart card with an unconnected card reader to avoid this problem.

The customer enters a challenge received from the bank's website, a PIN and the transaction amount into the reader. The reader returns an 8-digit signature. This signature is manually entered into the personal computer and verified by the bank, preventing from changing the transaction amount. Smart cards have also been the targets of security attacks. These attacks range from physical invasion of the card's electronics, to non-invasive attacks that exploit weaknesses in the card's software or hardware.

The usual goal is to expose private encryption keys and then read and manipulate secure data such as funds. Once an attacker develops a non-invasive attack for a particular smart card model, he or she is typically able to perform the attack on other cards of that model in seconds, often using equipment that can be disguised as a normal smart card reader. While manufacturers may develop new card models with additional, it may be costly or inconvenient for users to upgrade vulnerable systems.

And audit features in a smart card system help manage the risks of compromised cards. Another problem is the lack of standards for functionality and security. To address this problem, the Berlin Group launched the ERIDANE Project to propose 'a new functional and security framework for smart-card based Point of Interaction (POI) equipment'. See also.